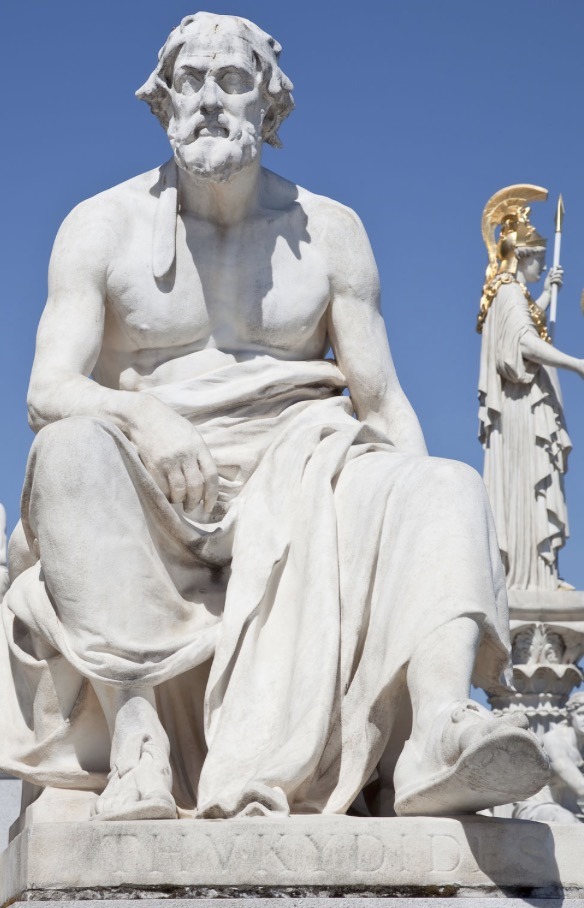

The defining question about global order for this generation is whether China and the United States can escape Thucydides’s Trap. The Greek historian’s metaphor reminds us of the attendant dangers when a rising power rivals a ruling power—as Athens challenged Sparta in ancient Greece, or as Germany did Britain a century ago. Most such contests have ended badly, often for both nations, a team of mine at the Harvard Belfer Center for Science and International Affairs has concluded after analyzing the historical record. In 12 of 16 cases over the past 500 years, the result was war. When the parties avoided war, it required huge, painful adjustments in attitudes and actions on the part not just of the challenger but also the challenged.

– From Graham Allison’s article: The Thucydides Trap: Are the U.S. and China Headed for War?

For the past two years, my geopolitical assumption has been that the Trump administration would more or less continue along with the reckless, shortsighted, and disastrous neocon/neoliberal interventionist foreign policy of the past two decades focused on undeclared regime change and proxy wars across the world, especially the Middle East. Given his strange obsession with Iran, I figured he’d start a conflict there and that this conflict would end up a bigger disaster than Iraq. Continue reading →